In today’s competitive market, the right approach to customer acquisition and retention is through the delivery of superior customer experience – starting at the onboarding process.

Merchant and client onboarding processes are both riddled with paperwork including KYC, adherence to government regulations, background checks, and so on. In keeping with statutory compliances and standard procedures, this process itself cannot be modified. Although challenging, there are definite ways to make the process smoother, faster, and hassle-free with digital onboarding and a DevOps approach. But there still seem to be gaps in the payment integration process!

Payment Peeves

The payment integration process is an important part of onboarding. However, despite having identified the right processor, most banks seem to struggle with a poor integration process due to complications in documentation, standardizations, and APIs.

These are some of the integration challenges faced by banks during the payment process:

- Payment Processor Integration

Most banks have a convoluted process that requires a separate merchant sign-up for integration with the payment processor. This not only makes the onboarding process frustrating for the customer but also leads to loss of valuable time.

- Data Integration

Banks need to collect and capture a lot of data during the payment merchant onboarding process. The process often requires too much manual effort and time, especially if disconnected legacy systems are used.

- Speedy Integration

With so much competition, the speed of the onboarding process becomes a determining factor in making or breaking a business relationship. Merchants and customers alike expect rapid response time and approval for payment acceptance in minutes.

Getting it Right

According to a study conducted among 500 financial decision-makers from mid-market companies, over 95% of them agreed that moving their payment transactions to the cloud was necessary to keep up with the pace of technological advancement affordably. Over 94% of the participants also cited that a cloud-based payment integration platform had positive effects on new and existing customers and other stakeholders.

The same study also revealed that other benefits include streamlining of processes like payment execution and automatic ledger reconciliation of payments, processes, leading to improved efficiency, as well as cost and time savings for the company.

- First and foremost, therefore, opt for cloud-enabled onboarding and payment integration to reach out to customers anywhere and through every possible device, streamline processes, and proactively improve efficiency and productivity.

- Design a customer-focused onboarding experience that automates processes with technology that can facilitate quick, accurate, and reliable onboarding.

- Keep the process as simple as possible with an onboarding API that enables a payment processor. Make sure the payment logic fits right into the original sign-in process and avoid the need for repetition and/or redirection during the integration process.

- Integrate disparate systems such as internal systems, data services, databases, and other systems on a platform equipped with pre-integrated adapters.

- Automate the process to enable the rapid and seamless integration of data in real-time and through batch collections.

CloudNow’s Integration Solutions

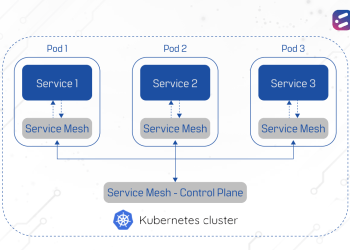

Payment services like First Data and PayPal require scalable, agile, secure solutions to integrate efficiently. And at CloudNow, we develop technology solutions that meet all of these needs. Our solutions can help you scale with thinner stacks, handle errors easily, gain more flexibility, stay resilient to failure, and always stay in control!

We recently helped an established global bank integrate the payment process with First Data, despite a number of challenges, with a cloud platform, microservices-based architecture, and RESTful APIs. Read the full case study to know more!

For more information on our services, click here or get in touch with us!